bne IntelliNews – Emerging markets see $4 billion outflow in June as global recession fears rise

Emerging markets saw $4 billion in outflows in June as fears of a coming global recession grew, the Institute of International Finance (IIF) said in a July 6 update.

“We estimate that emerging stocks suffered an outflow of $4.0 billion in June 2022, making it the fourth consecutive month of outflows,” Jonathon Fortum, an economist at IIF, said in a note.

Following the shock caused by Russia’s invasion of Ukraine in February, the effects of the war and associated sanctions are beginning to ripple through the global economy, raising fears that stagflation could tip the global economy into recession.

The World Bank nearly halved its forecast for global growth to 2.8% in June and now global commodity prices have slipped off their April highs as traders worried about supply, falling drastically in the past few weeks alone, as traders shifted their concerns to waning demand. Oil prices fell below $100 a barrel on June 6 for the first time since the start of the war, and copper prices, widely seen as a forward-looking indicator of developments in the global economy, fell from a record high of $10,500. a ton in April at around $7,500 now.

At the same time, fears of slowing growth are fueled by soaring inflation that has led central banks around the world to aggressively hike rates. Economists say the tightening cycle is far from over, although central banks in emerging markets began to tighten much earlier than their counterparts in developed markets, led by Russia and Ukraine in March of l ‘last year. Even after these hikes, many countries still have deeply negative real interest rates. “We are in a global shock of interest rates and high inflation,” says Fortum.

“The growing risk of a global recession weighs on emerging market flows as anxiety grows over geopolitical events, tighter monetary conditions and realized inflation. Continued equity market volatility has significantly hurt the outlook,” Fortum added.

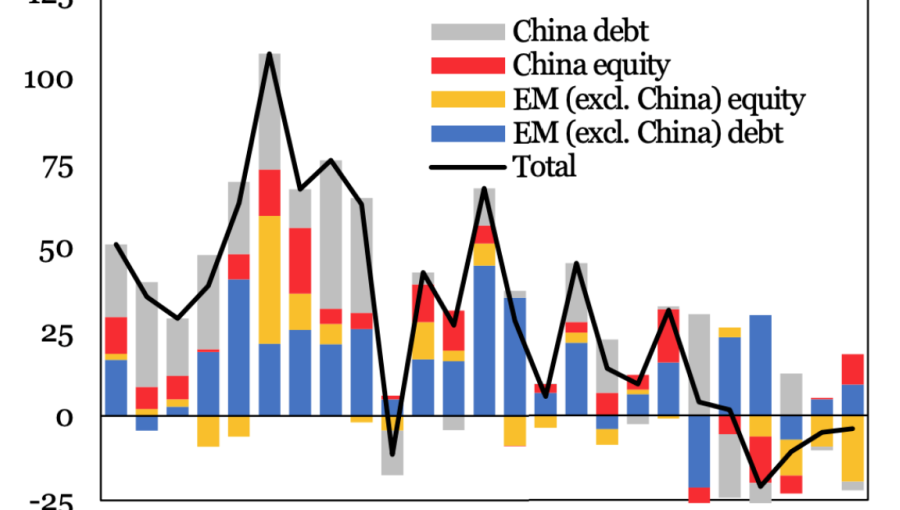

The IIF’s capital flow monitor has signaled significant outflows from some key emerging markets. Emerging equities (excluding China) saw $19.6 billion in outflows in June, while China saw $9.1 billion in inflows over the same period.

Emerging debt saw $9.1 billion in inflows, mostly targeting corporate bonds, while Chinese debt saw $2.5 billion out.

Growing concerns drove yields higher at the longer end of the bond curve in the developed world on tighter monetary policy and rising ‘risk off’ sentiment. That, in turn, sucks money out of emerging markets, according to the IIF, is an “episode of outflows of a magnitude similar to the RMB devaluation scare of 2015 and 2016.”

The duration of this development will depend on when the rise in inflation reaches its peak. The drastic action by the Central Bank of Russia (CBR) at the end of February to raise rates as soon as the risk of inflation became evident means that Russian inflation has probably already passed its peak. Inflation in Ukraine is also said to be already falling, but the National Bank of Ukraine (NBU) has been forced to print money to finance the war, which threatens the economy, the NBU governor says , Kyrylo Shevchenko, in a recent comment.

Other countries in emerging Europe are a little further behind the curve, but thanks to a series of aggressive rate hikes, inflation should peak in many countries before the end of this year, as bne IntelliNews reported in an article on stagflation.

“Despite recent readings, we remain constructive as most major emerging markets started to climb well ahead of advanced economies, which now leaves longer-term real interest rates in many emerging countries well above of their G10 counterparts,” Fortum said. “This offers some protection against the current shock to global interest rates. That said, there are obviously pockets of weakness in emerging markets – where real interest rates are deeply negative – and the risks for these countries are increasing. rapidly.

™™

Comments are closed.